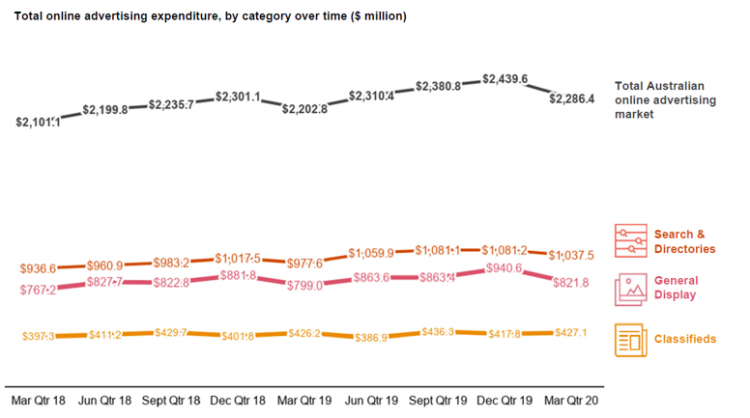

Total online advertising growth slowed in the first quarter of 2020 to deliver overall year-on-year growth of 3.8 per cent according to the IAB Australia Online Advertising Expenditure Report (OAER).

The report compiled by PwC, found that the drop in expenditure traditionally experienced after the December holiday quarter was more pronounced this year, with the total advertising in Q1 reaching $2.286m in expenditure.

The report, which captures data until 30th March 2020, reflects the traumatic summer season of bushfires and drought, as well as the traditional post-Christmas decline, but only includes a couple of weeks of data when the country was seriously impacted by COVID-19 lockdown.

Gai Le Roy, CEO of IAB Australia commented: “While this report captures the zeitgeist of the tough start to the year we experienced Australia wide, it precedes the real impact of COVID-19. There is no doubt that the current quarter will be tougher for all in the industry but we are seeing shoots of hope in some sectors.”

Additional findings from the IAB OAER Report from PwC

- All online advertising categories showed growth year on year, but general display and search & directories declined from the preceding December quarter (12 per cent and four per cent respectively. Classifieds grew two per cent from the December quarter. Video advertising continued to grow, increasing to 53 per cent share of general display advertising, an 18 per cent growth on the same quarter last year.

- The skew towards programmatic advertising continued, with 43 per cent of all advertising bought programmatically versus 38 per cent being bought from agencies using insertion orders (IOs). The percentage of inventory bought directly from advertisers increased to 19 per cent. Some 56 per cent, the bulk of content publisher’s video inventory, was bought programmatically in the March quarter.

- For the first time, the entertainment category entered the top five industry categories, joining retail, finance, real estate and automotive, despite all recording declines against the previous quarter. The technology sector experienced the largest increase in share quarter on quarter, while the travel sector experienced the largest decline.

- The report also found that in Q1, content publisher’s desktop video inventory revenue share increased slightly to 36 per cent with an increase in people working from home, up from 34 per cnet the preceding quarter, while viewing via connected TVs was 38 per cent and 26 per cent viewed via mobile video advertising.

Published by B&T